Understanding Medicare Supplement Plans

Medicare Supplement plans, also known as Medigap, are insurance policies designed to fill the gaps in Original Medicare (Part A and Part B) coverage. These plans are offered by private insurance companies and can help cover out-of-pocket costs such as copayments, coinsurance, and deductibles. Here’s a comprehensive look at what Medicare Supplement plans entail and how they can benefit you.

What Are Medicare Supplement Plans?

Medicare Supplement plans are standardized insurance policies that work alongside Original Medicare. They are designed to cover some of the healthcare costs that Original Medicare does not, such as:

- Copayments: The fixed amount you pay for a covered healthcare service.

- Coinsurance: Your share of the costs of a covered healthcare service, usually a percentage.

- Deductibles: The amount you pay for healthcare services before your insurance begins to pay.

Types of Medicare Supplement Plans

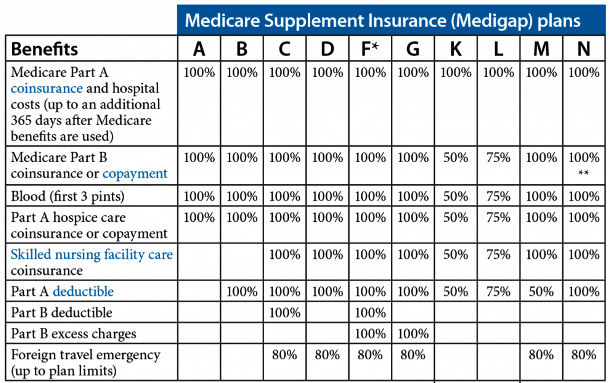

There are ten standardized Medigap plans available in most states, labeled A through N. Each plan offers a different level of coverage, but the benefits of each plan are the same regardless of the insurance company offering it. Here’s a brief overview of some of the most common plans:

- Plan A: Provides basic benefits, including coverage for Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

- Plan B: Includes everything in Plan A, plus coverage for the Medicare Part A deductible.

- Plan C: Offers comprehensive coverage, including the Medicare Part B deductible (Note: Plan C is not available to new Medicare beneficiaries starting January 1, 2020).

- Plan D: Covers everything in Plan C except the Medicare Part B deductible.

- Plan F: Provides the most comprehensive coverage, including the Medicare Part B deductible (Note: Plan F is also not available to new Medicare beneficiaries starting January 1, 2020).

- Plan G: Similar to Plan F but does not cover the Medicare Part B deductible.

- Plan K: Offers lower premiums with higher out-of-pocket costs, covering 50% of certain costs.

- Plan L: Covers 75% of certain costs with moderate premiums.

- Plan M: Covers 50% of the Medicare Part A deductible and 100% of the Medicare Part B coinsurance.

- Plan N: Covers the Medicare Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits.

Enrollment and Eligibility

To be eligible for a Medicare Supplement plan, you must be enrolled in Medicare Part A and Part B. The best time to purchase a Medigap policy is during your Medigap Open Enrollment Period, which is a six-month period that starts the month you turn 65 and are enrolled in Part B. During this period, you have a guaranteed issue right, meaning you can buy any Medigap policy sold in your state without medical underwriting.

Costs of Medicare Supplement Plans

The cost of a Medigap policy varies depending on several factors, including the plan you choose, your age, gender, location, and the insurance company. Generally, Medigap policies have higher premiums but lower out-of-pocket costs compared to Medicare Advantage plans. It’s important to compare different plans and insurance companies to find the best coverage at the most affordable price.

Benefits of Medicare Supplement Plans

Medicare Supplement plans offer several advantages:

- Predictable Costs: With a Medigap policy, you can better predict your healthcare costs, as these plans cover many of the out-of-pocket expenses that Original Medicare does not.

- Nationwide Coverage: Medigap policies are accepted by any healthcare provider that accepts Medicare, providing you with nationwide coverage.

- No Network Restrictions: Unlike Medicare Advantage plans, Medigap policies do not have network restrictions, allowing you to see any doctor or specialist who accepts Medicare.

- Guaranteed Renewable: As long as you pay your premiums, your Medigap policy cannot be canceled, even if you have health problems.

Key Considerations

When choosing a Medicare Supplement plan, consider the following:

- Coverage Needs: Assess your healthcare needs and compare the benefits of different Medigap plans.

- Costs: Compare premiums and out-of-pocket costs for different plans and insurance companies.

- Enrollment Periods: Be aware of your Medigap Open Enrollment Period to take advantage of guaranteed issue rights.

Medicare Supplement plans can provide valuable coverage and peace of mind by helping to manage healthcare costs not covered by Original Medicare. By understanding your options and carefully comparing plans, you can find the coverage that best fits your needs and budge